Saving money is a tricky mistress. Sometimes we think we are doing the best we can each month and yet our money seems to continue to run away from us.

And, unfortunately, this might be a thing that we always find difficult in our lives and that we always have to work on.

But, luckily, there are easy and accessible ways that we can work on it right now without having to engage in any big schemes or learning any really difficult financial lingo.

Here are 3 ways that I find really help me save money and that might just help you save a little more going in the New Year.

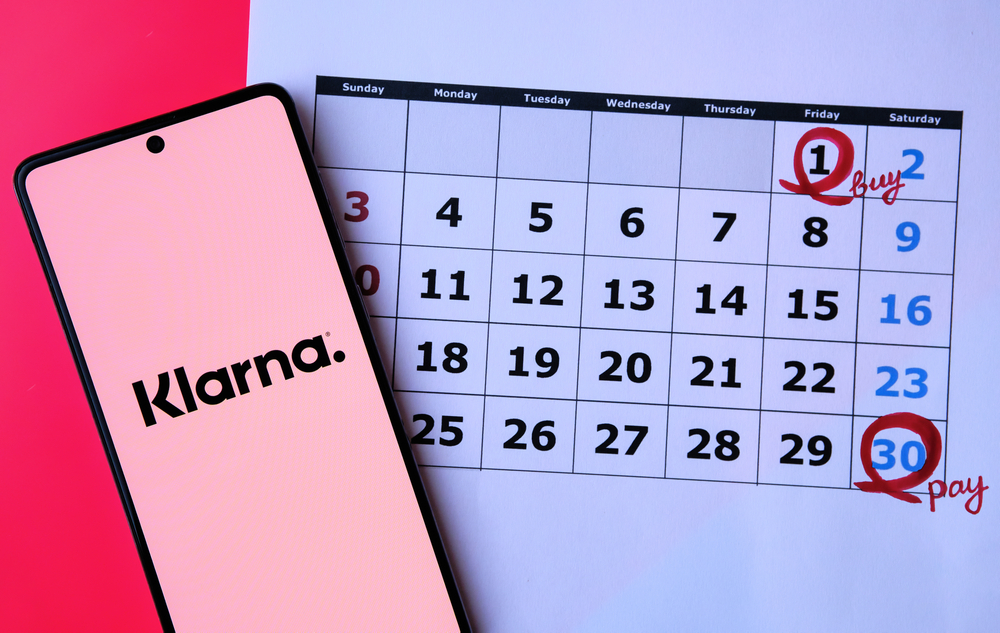

Avoid Klarna, easy payments, and delayed payments

While alternative forms of payment seem very attractive, they aren’t always a great way to manage our money and they certainly hinder us from saving money.

Payment options that include delaying our payments or paying in multiple instalments are becoming more and more popular and they are available on a very wide range of sites and platforms.

They convince us that we are paying less than we are and they convince us that we are making our money stretch farther.

But really, if we can’t afford to pay for something in one go, then we can’t afford to pay for it at all.

These forms of payment don’t build our credit either and so if we don’t want something that is more of a traditional system that helps us build our credit scores, we just need a credit card, nothing else. But use these with caution too.

Create a savings account separate from your main account

The easiest way to save money is to create a savings account that you don’t touch until you really need it. You need to be firm with yourself and set limits and boundaries, otherwise, you will simply end up seeing your savings bank account as just a second bank account.

A great option is to set up a direct debit from your main account every week or month that automates how much you want to save. And then don’t look at your savings account. This way, your money will grow steadily over time and gather some interest.

If you make £2,500 per month and you send £500 in an automated payment to a savings account with a small 1.5% interest rate every month, you will have £6,041.42 by the end of the year.

It is definitely worth it.

Keep accurate track of your spending using software and/or apps

Often we aren’t saving as much money as we should be because we don’t even know how much we are spending per month.

A great way to keep an accurate tab on your spending and saving is by using a third-party app or software to help you out. Some banking apps now have an in-house option but you can also use services such as Monzo.

If we know clearly how much we are spending each month, we can target which areas we need to cut down and change. If we don’t know, we can carry on spending beyond our means forever and never-ending up with any savings.

I guarantee once you start saving properly, you will never look back.

Let’s all make a positive change for ourselves and our lives this incoming New Year, what do you say?